(All dollar amounts are in United States dollars unless otherwise specified)

December 17, 2021, Vancouver, B.C. - Bear Creek Mining Corporation (“Bear Creek” or the “Company”) (TSXV: BCM) (OTCQX: BCEKF) (BVL: BCM) is very pleased to announce it has entered into a definitive agreement with Equinox Gold Corp. (“Equinox”) to acquire a 100% interest in the Mercedes gold-silver mine (“Mercedes”) located in Sonora, Mexico.

The Mercedes acquisition will transform Bear Creek into a precious metal producer and provide a source of funding for future construction of the Company’s world class Corani silver mine.

Benefits of the Mercedes acquisition to Bear Creek shareholders

The Mercedes acquisition will:

- Add a high quality, low cost, cash flowing asset to Bear Creek’s project portfolio

- Provide a source of free cash flow to help fund development and construction of the Corani silver mine

- Offer excellent near-mine and regional exploration upside

- Diversify Bear Creek’s asset base with mix of jurisdictions, project stages and commodities while retaining a precious metals focus

- Create an opportunity for re-rating of the Company’s shares to align with junior precious metals producers

- Enhance the Company’s share registry and market profile with the addition of two new strategic stakeholders

“Moving from a development stage company into a precious metals producer is an important step in Bear Creek’s evolution”, states Anthony Hawkshaw, President and CEO of the Company. “The acquisition of Mercedes provides our shareholders a cash flowing asset with expansion potential and participation in a land package with an exciting exploration outlook. Furthermore, the financial and technical support provided by Sandstorm reinforces management’s conviction that Mercedes will be a positive contributor to each of our treasuries; a positive contribution that for Bear Creek will, in large part, be directed to the continuing development of Corani.”

Strategic Rationale

The Mercedes acquisition adds an attractive operating asset that provides free cash flow, which the Company will use as a non-dilutive source of funding to develop the Company’s world-class Corani silver deposit, and to explore the Mercedes property. With a strong track record of exploration success, consistent historical replacement of ore reserves, and vast areas of the property unexplored, management believes the Mercedes property offers exploration upside with the potential to expand known reserves and extend the mine life beyond current projections, with ample spare mill capacity for expansion of production.

Key Acquisition Terms

Payment to Equinox will consist of:

- A cash payment of $75 million and issuance of 24,730,000 Bear Creek common shares on the closing of the acquisition (the “Closing Date”)

- A deferred cash payment of $25 million due within six months of the Closing Date

- A 2% NSR payable on metal production from the Mercedes mining concessions

The $75 million cash payment on the Closing Date will be funded by $15 million from the Company’s treasury and $60 million from Sandstorm Gold Ltd. (“Sandstorm”) as described below.

The Mercedes acquisition is expected to close during the first quarter of 2022 subject to customary closing conditions including approval of the TSX Venture Exchange and Mexican authorities.

Sandstorm Stream and Debt Financing

Bear Creek and Sandstorm have entered into a gold purchase agreement (the “Gold Purchase Agreement “) and a debt financing agreement, each of which are subject to customary closing conditions.

Under the Gold Purchase Agreement, Sandstorm will provide the Company with $37.5 million and in exchange Bear Creek will sell to Sandstorm 600 ounces of refined gold per month for 42 months (a total of 25,200 ounces) at a price equal to 7.5% of the spot gold price at the time of delivery. Thereafter, the Company will sell to Sandstorm 4.4% of gold produced by Mercedes at a price equal to 25% of the spot price at the time of delivery. Sandstorm will also be granted a right of first refusal on any royalties, streams or similar transactions with respect to production from Mercedes.

On the Closing Date, Sandstorm will pay the Company $22.5 million (the “Principal Amount”) to subscribe for a 6%, three-year Convertible Debenture. Interest will be paid quarterly on the outstanding Principal Amount. The Principal Amount may be reduced by conversion of debt to common shares of the Company during the term. Otherwise, the Principal Amount is due on the third anniversary of closing. The Principal Amount is convertible, in whole or in part, into common shares of the Company at any time prior to maturity at the greater of a 35% premium to the closing price per common share of the Company on the closing date of the acquisition or as otherwise permitted by the TSX-V.

Borden Ladner Gervais LLP is acting as legal advisor to Bear Creek in the Mercedes acquisition.

About Mercedes

The information in this section is derived from the NI 43-101 Technical Report, Mercedes Gold-Silver Mine with an effective date of December 31, 2020. Readers are urged to review the NI 43-101 Disclosure below for further details.

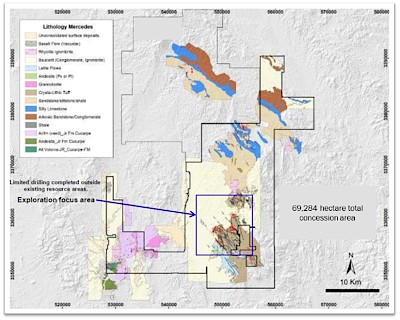

The Mercedes mine is located in the state of Sonora, Mexico, approximately 300 km northeast of the city of Hermosillo and 300 km south of Tucson, AZ, within the prolific Mexican epithermal gold belt. It comprises 43 mineral concessions covering 69,285 ha.

Gold-silver mineralization on the Mercedes property is hosted within epithermal, low sulphidation veins, stockwork, and breccia zones. Aside from a brief Covid-related shut down in the spring of 2020, Mercedes has been in continuous operation since commencing production in 2011. Up to December 31, 2020, 5.84 million tonnes grading 4.42 g/t gold and 49.5 g/t silver have been processed, with a total of approximately 781,800 ounces of gold and 3,356,200 ounces of silver produced.

The Mercedes mine is a ramp-access underground operation that utilizes fully mechanized cut-and-fill mining. Ore is processed by conventional milling followed by agitated leach with Merrill-Crowe recovery of gold and silver. The process plant has a capacity 2,000 tpd with an average production rate from 2016-2020 of approximately 1,450 tpd. From 2012-2020 the average gold and silver recovery rates were 95.4% and 39.2%, respectively.

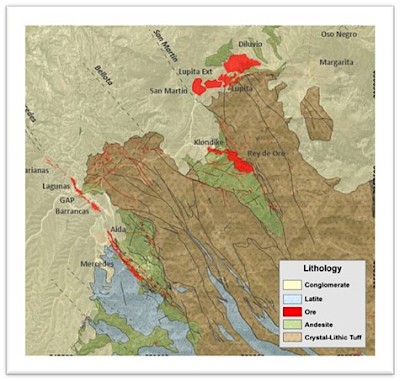

Throughout Mercedes’ production history, gold-silver ore has been produced from five deposit areas, of which two (Diluvio and Lupita) are currently being mined. Thirteen mineralized zones in four vein systems have been identified to date within the Mercedes property through surface and underground drilling. These mineralized zones occur in three sub-districts: Mercedes (Mercedes and Barrancas – Marianas vein systems); Klondike (Klondike – Rey de Oro vein system); and Lupita (Lupita- Diluvio vein system). Readers are referred to the Mercedes Project and Deposit maps, below.

While the geological setting of the Mercedes property is very prospective, most of the property area has seen little to no substantive exploration. Conceptually, additional vein zones with tonnages and grades similar to currently mined areas could be discovered and delineated as systematic exploration continues. District-wide studies suggest that approximately 45 km of structures remain to be tested for short-term, near-mine evaluation, as well as long-term generative exploration, which may have potential for hosting additional low sulphidation gold-silver bearing vein systems.

The Mercedes property is estimated to contain the following Mineral Reserves and Mineral Resources (1):

| Mercedes Mineral Reserves | |||||

| Contained Metal | |||||

| Category | Tonnage (‘000 tonnes) |

Gold Grade g/t |

Silver Grade g/t |

Gold (‘000 oz) |

Silver (‘000 oz) |

| Proven | 381 | 5.47 | 41 .3 | 67 | 507 |

| Probable | 2,224 | 3.61 | 27.2 | 258 | 1,943 |

| Proven & Probable | 2,605 | 3.89 | 29.2 | 325 | 2,450 |

| Mercedes Mineral Resources in addition to Reserves | |||||

| Contained Metal | |||||

| Category | Tonnage (‘000 tonnes) |

Gold Grade g/t |

Silver Grade g/t |

Gold (‘000 oz) |

Silver (‘000 oz) |

| Measured | 521 | 3.59 | 31.2 | 60 | 2,633 |

| Indicated | 2,220 | 3.22 | 36.9 | 230 | 641 |

| Measured & Indicated | 2,742 | 3.29 | 35.8 | 290 | 3,155 |

| Inferred | 1,545 | 4,73 | 44.0 | 235 | 2,186 |

<>sup>(1) The effective date of these Mineral Reserve and Mineral Resource estimates is December 31, 2020. See NI 43-101 Disclosure, below, for the assumptions used in the estimation of the Mercedes Mineral Reserves and Mineral Resources

Mercedes Project and Deposit Maps

|

Mercedes Location Map |

Mercedes Concession Map |

|

Mercedes Known Gold-Silver Deposits |

|

|

|

Bear Creek Mining will host a webcast presentation on the Mercedes mine acquisition as follows:

|

WHEN? |

Friday, December 17, 2021 at 8:00 am Pacific time / 11:00 am Eastern time |

|

WHERE? |

https://viavid.webcasts.com/starthere.jsp?ei=1520117&tp_key=3a7adad69b |

Interested parties are encouraged to visit the webcast url provided above in advance of the scheduled presentation time as registration is required.

On behalf of the Board of Directors,

Anthony Hawkshaw

President and CEO

For further information contact:

Barbara Henderson – VP Corporate Communications

Direct: 604-628-1111

E-mail: barb@bearcreekmining.com

www.bearcreekmining.com

Forward-looking Statements

This news release contains forward-looking statements regarding: the structure, anticipated closing date and regulatory approval of the Acquisition; the merits and expected benefits of the Acquisition to the Company and its shareholders; the terms and conditions of the Sandstorm Gold Stream and the Sandstorm Convertible Debenture; the anticipated future operating performance, production and cash flow from the Mercedes Mine; the potential for the discovery of additional mineralized vein systems and mineralized bodies at the Mercedes property; the possibility of defining additional mineral resources within the Mercedes property, to convert known or future mineral resources to mineral reserves, and to extend the current Mercedes Mine life projection; the Company’s plans to direct free cash flow from Mercedes toward the development and construction of the proposed Corani Mine; the potential benefits of the Acquisition to the Company’s ongoing Corani project financing efforts; the potential for re-rating of the Company’s shares; and other statements regarding future plans, expectations, guidance, projections, objectives, estimates and forecasts as well as the Company’s expectations with respect to such matters. These forward-looking statements are provided as of the date of this news release, or the effective date of the documents referred to in this news release, as applicable, and reflect predictions, expectations or beliefs regarding future events based on the Company’s beliefs at the time the statements were made, as well as various assumptions made by and information currently available to them. In making the forward-looking statements included in this news release, the Company has applied several material assumptions, including, but not limited to: that the terms and conditions of the Acquisition, the Sandstorm Gold Stream and the Sandstorm Convertible Debenture will not be subject to material changes; that the Acquisition will be approved by regulators; that the documents, projections and models on which the Company has relied are accurate in all material respects; and, that the Company will continue to seek financing for and develop the Corani project in accordance with its stated strategies. Although management considers these assumptions to be reasonable based on information available to it, they may prove to be incorrect. By their very nature, forward-looking statements involve inherent risks and uncertainties, both general and specific, and risks exist that estimates, forecasts, projections and other forward-looking statements will not be achieved or that assumptions on which they are based do not reflect future experience. We caution readers not to place undue reliance on these forward-looking statements as a number of important factors could cause the actual outcomes to differ materially from the expectations expressed in them. These risk factors may be generally stated as the risk that the assumptions expressed above do not occur, but specifically include, without limitation, risks relating to general market conditions and the additional risks described in the Company’s latest Annual Information Form, and other disclosure documents filed by the Company on SEDAR. The foregoing list of factors that may affect future results is not exhaustive. Investors and others should carefully consider the foregoing factors and other uncertainties and potential events. The Company does not undertake to update any forward-looking statement, whether written or oral, that may be made from time to time by the Company or on behalf of the Company, except as required by law.

NI 43-101 Disclosure

Disclosure of a scientific or technical nature in this news release has been reviewed and approved by, Andrew Swarthout, AIPG Certified Professional Geologist, Director of the Company and a Qualified Person (“QP”) as defined in NI 43-101.

Technical information regarding the Mercedes property and mining operation included in this news release is derived from a NI 43-101 Technical Report entitled “NI 43-101 Technical Report on the Mercedes Gold-Silver Mine, Sonora State, Mexico” (the “2020 Mercedes Report”) dated June 30, 2021, with an effective date of December 31, 2020. The 2020 Mercedes Report is available on SEDAR under the profile of Equinox Gold Corp.

The 2020 Mercedes Report was prepared on behalf of Equinox Gold Corp. by BBA Inc. and G Mining Services Inc. and was authored by following QPs: Julie-Anaïs Debreil, P. Geo. (G Mining) responsible for Chapters 10, 11, & 12; Colin Hardie, P. Eng., (BBA) responsible for Chapters 1, 2,3,13, 17, 18, 19, 20, 21, 22, 24, 25, 26 & 27; Todd McCracken, P. Geo. (BBA) responsible for Chapters 4, 5, 6, 7, 8, 9, 14 & 23; and, David Willock, P. Eng., (BBA) responsible for Chapters 15 & 16. All of the 2020 Mercedes Report QPs contributed to Chapters 1, 25, 26 and 27, based upon their respective scope of work and the chapters/sections under their responsibility.

Mercedes Reserve estimate assumptions

- CIM Definitions Standards on Mineral Resource and Reserves (2014) have been followed.

- Mineral Reserves are minable tonnes and grades; the reference point is the mill feed at the primary crusher.

- Mineral Reserves are estimated at a cut-off of 2.10 g/t Au, except Diluvio, which is estimated at 2.00 g/t Au.

- Cut-off grade assumes a price of gold of US$1,350 per ounce, a 95.5% gold metallurgical recovery; US$45.09/t mining cost, US$19.59/t processing costs, US$13.00/t G&A and US$8.48/oz refining costs.

- A minimum mining width of 3.5 m was used in the creation of all reserve blocks.

Mercedes Resource estimate assumptions

- The CIM Definition Standards on Mineral Resource and Reserves (2014) have been followed.

- Mineral Resources are exclusive of Mineral Reserves.

- Mineral Resources that are not Mineral Reserves have not demonstrated economic viability.

- The mineral resource cut-off grade of 1.70 g/t gold was calculated using the following parameters: gold price =US$1,500/oz; metallurgical recoveries of 95.5% for gold; refining charges US$8.48/oz gold; mining costs of US$44.70, processing costs of US$21.60 and G&A costs of US$13.00 per tonne of ore.

Cautionary Note to United States Investors Concerning Estimates of Measured, Indicated and Inferred Resources

The Company prepares its disclosure in accordance with the requirements of securities laws in effect in Canada, which differ from the requirements of U.S. securities laws. Terms relating to mineral resources in this news release are defined in accordance with NI 43-101 under the guidelines set out in the Canadian Institute of Mining, Metallurgy, and Petroleum Definition Standards for Mineral Resources and Mineral Reserves 2014 (“CIM Definition Standards”).

The United States Securities and Exchange Commission (the “SEC”) has adopted amendments effective February 25, 2019 (the “SEC Modernization Rules”) to its disclosure rules to modernize the mineral property disclosure requirements for issuers whose securities are registered with the SEC under the United States Securities Exchange Act of 1934. The SEC Modernization Rules have replaced SEC Industry Guide 7, which has been rescinded.

As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of “Measured mineral resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources”, which are defined in substantially similar terms to the corresponding CIM Definition Standards. In addition, the SEC has amended its definitions of “Proven Mineral Reserves” and “Probable Mineral Reserves” to be substantially similar to the corresponding CIM Definition Standards.

United States investors are cautioned that while the foregoing terms are “substantially similar” to corresponding definitions under the CIM Definition Standards, there are differences in the definitions under the SEC Modernization Rules and the CIM Definition Standards. Accordingly, there is no assurance any Mineral Resources that the Company may report as “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources” under NI 43-101 would be the same had the Company prepared the resource estimates under the standards adopted under the SEC Modernization Rules.

United States investors are also cautioned that while the SEC will now recognize “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources”, investors should not assume that any part or all of the mineral deposits in these categories would ever be converted into a higher category of Mineral Resources or into Mineral Reserves. Mineralization described by these terms has a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. Accordingly, investors are cautioned not to assume that any “Measured Mineral Resources”, “Indicated Mineral Resources”, or “Inferred Mineral Resources” that the Company reports are or will be economically or legally mineable.

Further, “Inferred Mineral Resources” have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Therefore, United States investors are also cautioned not to assume that all or any part of the Inferred resources exist. In accordance with Canadian securities laws, estimates of “Inferred Mineral Resources” cannot form the basis of feasibility or other economic studies, except in limited circumstances where permitted under NI 43-101.

In addition, disclosure of “contained ounces” is permitted disclosure under Canadian regulations; however, the SEC has historically only permitted issuers to report mineralization as in place tonnage and grade without reference to unit measures.

Neither the TSX Venture Exchange nor its Regulatory Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.