Highlights

- Bear Creek’s wholly owned Corani deposit is one of the largest fully permitted silver-polymetallic deposits in the world.

- Corani is well-situated in a mining-compatible jurisdiction, near road and power infrastructure and in a sparsely populated region.

- Corani has sizeable Proven and Probable Reserves that will support average annual payable metal production of 9.6 M oz of silver, 98 M lb of lead and 69 M lb of zinc over a 15-year mine life. *

- The Corani deposit is economically robust, with low AISC over a 15-year mine life and fast payback of capital. *

- Corani has received all key permits required to commence construction including an approved ESIA, Accreditation of Water Availability and Construction Permits.

- Bear Creek has purchased all necessary surface rights.

- Life of Mine Agreements are in place with very supportive local communities.

Jump to 2019 Corani Report, below, for a summary of the results of the most recent Feasibility Study for the Corani Project.

Overview

PROJECT DESCRIPTION

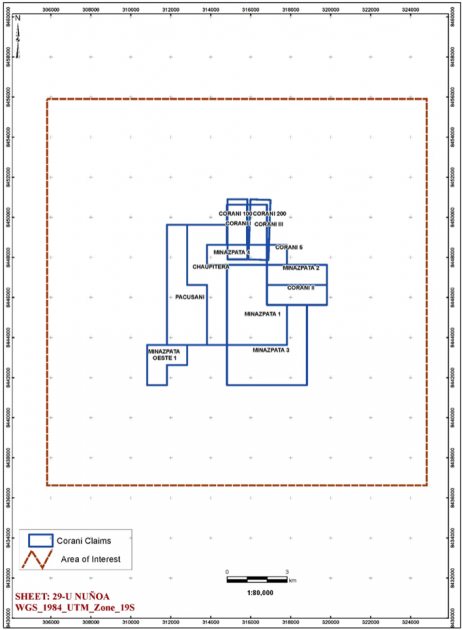

The 100% owned Corani silver-lead-zinc property is located in the district of Corani, province of Carabaya, in the department of Puno in southern Peru.

The Corani deposit sits at an elevation of between 4,800 and 5,200 meters above sea level, on the eastern side of the Continental Divide in the Andes Mountains. The project consists of thirteen mineral concessions that form a contiguous block of ground covering approximately 5,500 hectares.

The Corani area is a high desert mountainous environment dominated by volcanic rock and overlying glacial gravel. Aside from vegetation associated with wetlands (aka “bofedal”), alpine tussock grassland (aka ”puna”) occupies most of the valleys and moderate slopes, while on steeper slopes, erosion and climatic conditions largely prevent the development of soils or vegetation.

The Corani project is accessible by road from the town of Macusani, located approximately 30 km due east of the property on the paved dual lane Interoceanic Highway. Macusani is readily accessible from the town of Juliaca, serviced by commercial airlines from Lima.

GEOLOGY AND MINERALIZATION

The Corani project area is underlain by Tertiary age volcanic rocks of the Quenamari Formation, a thick series of crystal-lithic tuffs and andesite. The primary host of mineralization is the youngest member of the Quenamari Formation, the Chacaconiza Member, comprised of a sequence of crystal-lithic and crystal-vitric-lithic tuffs. The Chacaconiza tuffs are widely hydrothermally altered and pervasively argillized to low-temperature clays, and are variably faulted, fractured, and brecciated.

The Corani deposit is best described as a low- to intermediate-sulfidation epithermal deposit with silver, lead, and zinc mineralization hosted in stock works, veins, and breccias. Mineralization at Corani occurs in three distinct and separate zones: Corani Main, Corani Minas, and Corani Este, each with slightly different alteration and mineral assemblages. In outcrop, Corani area mineralization is associated with iron and manganese oxides, barite, and silica, while in drill core, the mineralization occurs in typical low to intermediate sulfidation silver-lead-zinc (Ag-Pb-Zn) mineral assemblages. The most abundant silver-bearing mineral is fine-grained argentian tetrahedrite or freibergite.

EXPLORATION AND DRILLING

Bear Creek began exploration activities at the Corani property in 2005, initially under the terms of an option agreement with Rio Tinto and since 2011, as sole owners. Early exploration activities included surface geological mapping over the entire concession area (a roughly 4.5 x 7 km area), detailed lithological, alteration and structural mapping over the deposit area at a scale of 1:2,500, trenching, ground geophysics surveys (Induced Polarization and Magnetics), and core drilling.

Since 2005, Bear Creek has drilled 562 exploration drill holes at the Corani Project, for a total of approximately 101,401 m. In 2019, an additional six drill holes (totalling 906.0 m) were drilled at Corani to obtain material specifically for metallurgical test work. This additional core was also assayed for silver, lead, zinc, and copper, and the results were added to the project database for updating the resource estimate.

METALLURGY

The Corani deposit is a silver-lead-zinc deposit with varying mineralogy associated with specific mineral zones. The metallurgical response of Corani samples to flotation is heavily dependent on the mineralogy.

PERMITTING

In May 2018, the MEM approved the Authorization of Exploitation Activities (Corani Project Mining Plan), which authorizes the construction of the Corani Project and the construction of auxiliary and complementary mining facilities, such as access roads, the mine camp, and maintenance and storage buildings. Subsequently, in June 2018, the MEM approved the Authorization for the Construction of the Beneficiation Plant, which includes the main waste and tailings storage facility, surface water management and water supply well construction for the plant, and other auxiliary facilities.

Bear Creek has additionally obtained the Certificate of Inexistence of Archaeological Remains (“CIRA”) for 100% of the Corani Project Area. Based on the CIRA, in July 2018, the “Archaeological Monitoring Plan for the Corani (PMA) - Puno Project” was approved by the Ministry of Culture. With this permit, all the permits and approvals linked to the start of construction of the Corani project were completed.

In September 2018, the Company notified the MEM that of its commencement of early construction works for the Corani project. These “Early Works” are presently being executed

2019 Corani Report

Key changes from the 2017 Corani Technical Report incorporated in the 2019 Corani Report.

The 2019 Report incorporates several physical changes, the most significant of which are:

- Revising the mine plan, de-bottlenecking the process plant and increasing filter capacity to obtain a 20% increase in daily ore production from 22,500 tonnes per day (“tpd”) to 27,000 tpd.

- Re-routing the mine access road to simplify access to the Corani site and allow for a redesign of the internal haul roads.

- Re-designing mine haul roads to reduce ore and waste haulage distance by an average of 2 km.

- Updating the water balance to match higher ore throughput.

- Changing the location of the concentrator, reducing cut and fill earthworks.

- Re-designing the concentrator to reduce its footprint by 30%, resulting in lower earthwork, concrete and steel costs.

- Preparing a new block model and mine plan for ore and waste. There was no material change to the Corani Mineral Reserves and Mineral Resources as outlined in the 2017 Corani Report.

The principal work and studies undertaken to reduce risk include:

- Additional metallurgical testing to confirm recovery formulas developed in 2017.

- Comminution test work to confirm mill capacities.

- Thickening, filtering and rheology tests to confirm handling characteristics of the tailings.

- Materials handling testing on crushed ore and filtered tailings for stockpile and conveyor designs.

- Studies of tailings and mine geotechnical properties, tailings-waste co-disposal characteristics and tailings-waste disposal storage facility stability.

- Nine additional geotechnical drill holes, 28 test pits, 31 Lightweight Dynamic Penetration Tests and 6 structural station evaluations were performed. These tests were in addition to 70 drill holes, 221 test pits and 68 previous tests to confirm facilities locations.

- A borrow source study to confirm the location, volume and quality of aggregate suitable for concrete.

- Substantial completion of an electrical substation. The connection to the high-tension electrical grid is planned for January 2020.

- Development of Owner’s Costs from first principles and benchmarking them against other recent projects, resulting in an increase from $32.3 million to $65.3 million.

- A legal review of the Peruvian tax regime.

- An updated concentrate marketing and transportation study.

ECONOMICS AND METAL PRICE SENSITIVITY

The following table shows the 2019 Corani Report after-tax NPV and IRR, and payback period, on an EPCM delivery model basis, at base case metal prices and at 10% higher and lower metal prices.

| Base Case (1) | +10% (2) | -10% (3) | |

|---|---|---|---|

| After tax NPV5 | $531 million | $739 million | $314 million |

| After tax NPV8 | $369 million | $534 million | $195 million |

| IRR | 22.9% | 28.1% | 16.7% |

| Initial Capital Payback | 2.4 years | 2.1 years | 2.9 years |

(1) $18.00/oz silver, $0.95/lb lead, $1.10/lb zinc

(2) $19.80/oz silver, $1.05/lb lead, $1.21/lb zinc

(3) $16.20/oz silver, $0.86/lb lead, $0.99/lb zinc

The principal assumptions used in the 2019 Report economic analysis are:

- LOM metal prices of $18.00 per ounce of silver, $0.95 per pound of lead and $1.10 per pound of zinc.

- Initial capital costs of $579 million.

- Total LOM sustaining capital of $22.5 million.

- Mine closure cost of $44 million ($25 million incurred during the project, $18 million for final closure and $1 million for post-closure).

- Daily ore processing of 27,000 tonnes.

- Smelter treatment charge of $111.50 per dry metric tonne (“DMT”) for lead concentrate and $231.30 per DMT of zinc concentrate.

- A refining charge of $0.80 per payable ounce of silver contained in lead concentrate. Payable silver is the lesser of 95% of contained silver or contained silver minus 50 grams. Payable lead is the lesser of the lead in concentrate minus 3% or 95% of contained lead.

- 70% of silver in zinc concentrate is payable after a deduction of 3 ounces. Payable zinc is the lesser of 85% of zinc in zinc concentrate or the concentrate zinc grade minus 8%.

- Average LOM costs, per tonne of ore, were determined to be $4.29 for mining; $7.19 for processing; $3.90 for smelting and refining; $2.85 for power supply; $1.88 for general and administrative expenses; $2.48 for freight; insurance, assay and moisture determination; and $3.10 for taxes and government payments.

CAPITAL COSTS

The 2019 Corani Report initial capital costs include:

| Millions | |

|---|---|

| Mine | $59 |

| Process Plant | $234 |

| On Site Infrastructure | $58 |

| Off Site Infrastructure | $26 |

| Field Indirect Costs | $21 |

| Other | $4 |

| Engineering and Construction Management | $60 |

| Owner’s Costs | $65 |

| Subtotal | $527 |

| Contingency | $52 |

| Total | $579 |

MINERAL RESOURCES AND RESERVES

The Mineral Reserves and Mineral Resources estimated at the Corani deposit did not materially change from the 2017 Technical Report, which are presented below.

MINERAL RESERVES

| CATEGORY | Million tonnes | Silver g/t |

Lead % | Zinc % |

Contained Silver Million oz |

Contained Lead Million lb | Contained Zinc Million lb |

|---|---|---|---|---|---|---|---|

| Proven | 20.8 | 65.8 | 1.03 | 0.71 | 44 | 472 | 323 |

| Probable | 118.3 | 47.5 | 0.87 | 0.57 | 181 | 2,274 | 1,486 |

| Proven & Probable | 139.1 | 50.3 | 0.90 | 0.59 | 225 | 2,746 | 1,809 |

Notes:

- The Mineral Reserves have been estimated using the definitions of the Canadian Institute of Mining, Metallurgy and Petroleum (CIM).

- The Mineral Reserves have been estimated using the following metal prices: $20.00/oz silver, $1.00/lb zinc, $0.95/lb lead using a revenue factor 1.00 pit shell as a basis for the pit design.

- Variable NSR cut-off values from $11/tonne to $23/tonne at different times in the production schedule to manage mill requirements and maximize project economics.

- The tonnes and grades shown above are considered a Mineral Reserve because they have been demonstrated to be economically viable through the Corani Project financial model using the following metal prices: $18.00/oz silver, $1.10/lb zinc, $0.95/lb lead.

MINERAL RESOURCES IN ADDITION TO RESERVES

| CATEGORY | Million tonnes | Silver g/t |

Lead % | Zinc % |

Contained Silver Million oz |

Contained Lead Million lb | Contained Zinc Million lb |

|---|---|---|---|---|---|---|---|

| Measured | 20.8 | 34.5 | 0.39 | 0.17 | 15 | 111 | 50 |

| Indicated | 83.3 | 26.9 | 0.38 | 0.27 | 72 | 701 | 500 |

| Measured & Indicated | 96.7 | 27.9 | 0.38 | 0.26 | 87 | 812 | 550 |

| Inferred | 39.9 | 37.2 | 0.58 | 0.40 | 48 | 511 | 352 |

Notes:

- The Mineral Resources have been estimated using the definitions of the Canadian Institute of Mining, Metallurgy and Petroleum (CIM).

- The Mineral Resources have been estimated using the following metal prices: $30/oz Ag, $1.425/lb Pb and $1.50/lb Zn.

- Cut-off was $9.49/tonne processing cost, plus $1.51 G&A cost which represents the internal process cut-off.

MINING ORE AND WASTE DISPOSAL

The Corani deposit will be mined using conventional open pit mining methods. The mining fleet will be provided by an experienced mining contractor. The contractor will deliver broken ore to the crusher and waste to the tailings and waste storage facility (“TSF”). The contactor will provide maintenance facilities and servicing for the mining fleet. The major mining equipment will consist of 140 tonne trucks, two 22 cubic meter diesel-electric shovels and one 19 cubic meter front-end loader. The average ore haul from Este is 2.2 km, from Main 1.2 km and Minas 1.3 km. The average waste haul from Este is 2.9 km, Main 1.2 km and Minas 3.3 km.

The mined ore will be crushed by a single gyratory crusher prior to two stages of grinding in a semi-autogenous (SAG) mill and ball mill. To reduce the water consumption, the tailings from the flotation circuits will be thickened in high-compression thickeners prior to filtration in conventional pressure filters. The filtered tailings will be co-disposed together with the mined waste to produce a stable waste deposit.

ORE PROCESSING AND TAILINGS DISPOSITION

Ore will be delivered to a gyratory crusher with a daily capacity of 43,000 tonnes and delivered to a conical coarse ore stockpile with a live capacity of 12,000 tonnes and a total capacity of 49,000 tonnes. Ore is reclaimed from beneath the stockpile with two apron feeders, each with the capacity to feed 100% of the plant throughput.

Ore is processed in a single grinding line consisting of a 7,000 kW single pinion SAG mill (8m x 8m) with pebble recycle and a 14,000 kW dual pinion ball mill (8m x 13m) operated in closed circuit with a 24 cyclone cluster to achieve a primary grind with a P80 of 90 microns.

Cyclone overflow is passed to Pb-Ag flotation at neutral pH where a Pb-Ag rougher concentrate is removed by mechanical flotation cells. Pb-Ag rougher concentrate is reground in a 2000 kW High Intensity Grinding (“HIG”) mill to a P80 of 30 microns. The Pb-Ag rougher concentrate is passed through three stages of cleaning flotation to produce a final Pb-Ag concentrate which is filtered on a horizontal press filter with a capacity of 600 tonnes per day. Pb-Ag concentrates will be loaded into standard 20 ft shipping containers at site for shipment.

Pb-Ag flotation tailings are passed to Zn flotation where the pH is increased to 11. Zn and minor amounts of Ag are recovered in a rougher concentrate by standard mechanical flotation cells. Zn rougher concentrate is reground in a 3000 kW HIG mill to a p80 of 30 microns and is passed to a three-stage cleaning circuit to produce a final Zn concentrate which is filtered on a horizontal press filter with a capacity of 400 tonnes per day. Zn concentrate will be transported to the port of Matarani for bulk shipment to smelters.

Tailings from the Zn flotation circuit are passed to two 42-meter diameter high compression thickeners where the solids are increased to 60% before being filtered on ten 150 tph vertical plate filters. Filtered tailings containing about 17 per cent moisture are then transferred to a stockpile before being transported to the combined waste facility (“TSF”). During the first three years of the mine tailings will be loaded into 140 tonne trucks by a 17 cubic meter loader then hauled to and placed at the TSF at an average cost of $1.62 per DMT. During year three a conveying system will be constructed at an estimated cost of $10 million to move tailings to the TSF and avoid higher trucking costs as the height of the TSF increases.

The filtered tailings and mine waste will be placed in separate adjacent modules parallel to the storage facility slope (perpendicular to the axis of the gorge); height and width of each module will be based on the tailings/waste ratio in the operational period. The disposal will be performed from upstream to downstream in order to facilitate water management. The final mine waste and tailings impoundment will be capped with non-acid generating (“NAG”) rock for closure. Potentially acid generating (“PAG”) material will be encapsulated with NAG material. The NAG/PAG ratio is high enough (over 70% NAG, based on current knowledge) to provide enough NAG material to encapsulate both filtered tailings and PAG.

ORE PRODUCTION

Ore production will be from three distinct open pits – the Este, Minas and Main pits. The Este Pit contains the highest silver grade and will account for the majority of ore produced in the first three years of operation. The Main Pit contains relatively higher lead grade and the Minas Pit has relatively higher zinc grade. The physical location and contained metal distribution in these pits allow for the mine plan to be dynamically changed to take advantage of metal price differentials in order to improve realized net smelter returns. Ongoing studies will refine the mine plan.

Expected Payable Metal Production is set out in the following table:

| Silver (million ozs) | Lead (million lbs) | Zinc (million lbs) | |

|---|---|---|---|

| Year 1 | 18 | 100 | 106 |

| Year 2 | 15 | 136 | 112 |

| Year 3 | 16 | 139 | 91 |

| Life of Mine (LOM) | 144 | 1,476 | 1,040 |

Cash and all in sustaining costs* (“AISC”) per unit of payable metal production are provided in the following table:

| Avg. Years 1-3 | LOM Average | |

|---|---|---|

| By-Product Basis | ||

| Silver oz – Cash Cost | $1.14 | $4.39 |

| Silver oz – AISC | $1.36 | $4.55 |

| Co-Product Basis | ||

| Silver oz – Cash Cost | $7.48 | $10.32 |

| Silver oz – AISC | $7.62 | $10.41 |

| Lead lb – Cash Cost | $0.30 | $0.43 |

| Lead lb – AISC | $0.30 | $0.44 |

| Zinc lb – Cash Cost | $0.35 | $0.49 |

| Zinc lb – AISC | $0.36 | $0.49 |

* Cash Cost includes all operating and reclamation expenditures. AISC includes cash cost plus sustaining capital.

The LOM waste to ore ratio is 1.4:1. Ore and waste production from the Este, Minas and Main pits, over the life of the Corani mine, is as follows:

| Pit | LOM Million Tonnes | |

|---|---|---|

| Este | Ore | 38 |

| Waste | 73 | |

| Minas | Ore | 72 |

| Waste | 99 | |

| Main | Ore | 28 |

| Waste | 25 | |

| Totals | Ore | 139 |

| Waste | 196 |

METALLURGICAL TEST WORK

Additional metallurgical test work was performed in 2018 and 2019 on 12 samples from 9 boreholes (6 of which were new, as described above) drilled in the Este, Minas, and Main pits to optimize the known flotation test conditions as well as the comminution parameters, reagents scheme, and dewatering of concentrates and tailing characteristics. The selected samples reasonably cover the entire ore deposit and included ore with some degree of oxidation and ore with low sulfide content. The information obtained validated and improved the recovery formulas, providing additional confidence in the Life of Mine production schedule. This test work confirmed that marketable quality lead and zinc concentrates can be produced using the processing parameters selected for the process plant design.

CONCENTRATE TRANSPORT AND MARKETING

Lead concentrate containing approximately 8% moisture will be transported in standard-sized lined and sealed containers from the plant to the container port at Matarani approximately 632 km from site. An estimated 14 truckloads per day of lead concentrate will be shipped during years 1-3 of the mine life after which the shipments will reduce to 10 truckloads per day.

Zinc concentrate containing about 8% moisture will be shipped in bulk from site to the bulk container port at Matarani. Approximately 9 zinc truckloads per day will be shipped during the first three years of the mine life and about 5 truckloads per day for the remaining life of the mine.

In the event that there are disruptions at the Matarani Port, Corani concentrates would be shipped to Ilo, which is 670 km from the mine or to Callao approximately 1,542 km from site.

No concentrate sales contracts have been entered into by the Company at this time.

Environment and CSR

Bear Creek Mining is extremely respectful of the people and communities that are or may be directly or indirectly affected by the development, construction and operation of the Corani mine. The Company places a very high priority on achieving and maintaining social licence to operate, which includes matters of community health, safety and security. The Company’s Corporate Social Responsibility and Sustainability goals are to partner with communities to improve their health and safety, and to avoid any potential threats to health, safety and security that may stem from the Corani mine. There are no dwellings or land use competition on the Corani mine site. No re-locations of people or wildlife are required. Please refer to the Sustainability page on this website for a fulsome discussion of Bear Creek’s ESG practices and programs.

ENVIRONMENTAL RESPONSIBILITY

Bear Creek Mining has conducted extensive, long-term, baseline studies of local flora, fauna, ground and surface water quantity and quality, and air quality. The Corani mine plan and ESIA include provisions for ongoing monitoring of these ecosystems and if necessary, rehabilitation or remediation of any adverse impacts on these ecosystems as a result of the Corani mine.

In certain cases, development of the Corani mine will result in improvements to the existing environmental conditions, particularly within the project footprint area. Baseline studies indicate a degree of degradation of water quality in the general vicinity of the mineralized zones, largely due to naturally-occurring oxidation of sulfide-bearing materials that are associated with the mineralized orebody, and additional environmental impacts that are associated with the presence of historic underground mine workings, areas of waste rock, and past mine tailings; all of which are a source of acid rock drainage (ARD). The Corani mine plan includes the reclamation of many of these existing environmental liabilities.

An approved Environmental and Social Impact Assessment (“ESIA”) which is required for the development of mining projects in Peru, was approved by the Ministry of Energy and Mines (“MEM”) in 2013, based on the Feasibility Study prepared in 2011. Two subsequent modifications to the ESIA have been approved: the first in 2016 and an additional modification in 2017.

The ESIA requires the filing of a mine closure plan. The mine closure plan was approved in April 2015. An update to the closure plan was approved in 2018.

Bear Creek completed a Life of Mine (LOM) Investment Agreement in June 2013 with the District of Corani, five surrounding communities, and relevant, ancillary organizations. The agreement specifies investment commitments over the 23-year project life, which includes the pre-production construction period. Under the agreement, annual payments are to be made into a trust designed to fund community projects totaling 4 million Soles per year (approximately US$1.2 million per year). Once the Project commences development, the payments will remain constant throughout the development and construction phases and during production. Under the LOM Agreement a trust structure has been established for approval of investments and disbursement of funds. Some initial projects have already been funded.

CORPORATE SOCIAL RESPONSIBILITY (CSR)

The Company’s Corani CSR programs have for more than a decade focused on providing, in partnership with local communities and in accordance with their self-identified priorities, opportunities to participate in and benefit from activities related to the Corani project and to generate novel economic opportunities and improve on historic economic activities. The Company’s goal is for the Corani mine to provide economic opportunities for local communities but that ideally, local communities build and experience economic benefits that are truly sustainable and not reliant upon the life cycle of the Corani mine.

In 2012, Bear Creek Mining partnered with Corani area communities to undertake a baseline study of the health and welfare of local populations, based on the United Nations’ Human Development Indices. The results of this study indicated: high levels of extreme poverty, malnutrition, infant mortality and illiteracy; limited access to health care, technology and educational opportunities beyond primary levels; significant seasonal migration and limited opportunity for economic growth. These results supported the decision of the Company, in partnership with local communities, to focus CSR initiatives on the inter-related areas of health, education and economic empowerment. The results to date have been profoundly positive and are outlined in detail on the Sustainability page of this website.

Next Steps

The Company’s immediate plans are to complete the Antapata electrical substation, which is expected to improve the consistent availability of power in the Carabaya province in 2020, to continue developing social programs and economic opportunities in partnership with the Corani communities, communicate the results of the 2019 Report to the investment community and resume discussions with potential project finance participants. Bear Creek’s Board of Directors will consider a construction decision after evaluating all relevant factors.

ADDITIONAL INFORMATION

Please refer to the NI 43-101 Disclosure section of this website for important information related to the 2019 Corani Report and the 2017 Technical Report.